There is so much confusion and unknown about the Kansas City Chiefs recent relocation. As the Johnson County Post wrote in a recent article, even though this project was announced weeks ago, the deal “isn’t finalized, and specifics of the deal remain largely under wraps.” Last month, the Governor announced that the Chiefs were moving their headquarters and training facilities to Olathe, Kansas. We heard that this move was “revolutionary” for the Olathe public schools. Olathe city officials mentioned the economic benefits of the move and “meaningful partnerships” that it has formed. Except, since this announcement, the Chiefs haven’t shared a single thing about this move, and Olathe officials are now admitting that “there are currently no official plans or agreements in place with the Chiefs.” Even today, we still have no clue where these facilities or buildings will actually be located. It also doesn’t help that most city officials who have yet to vote on this deal are forced to sign non-disclosure agreements until the deal is finished.

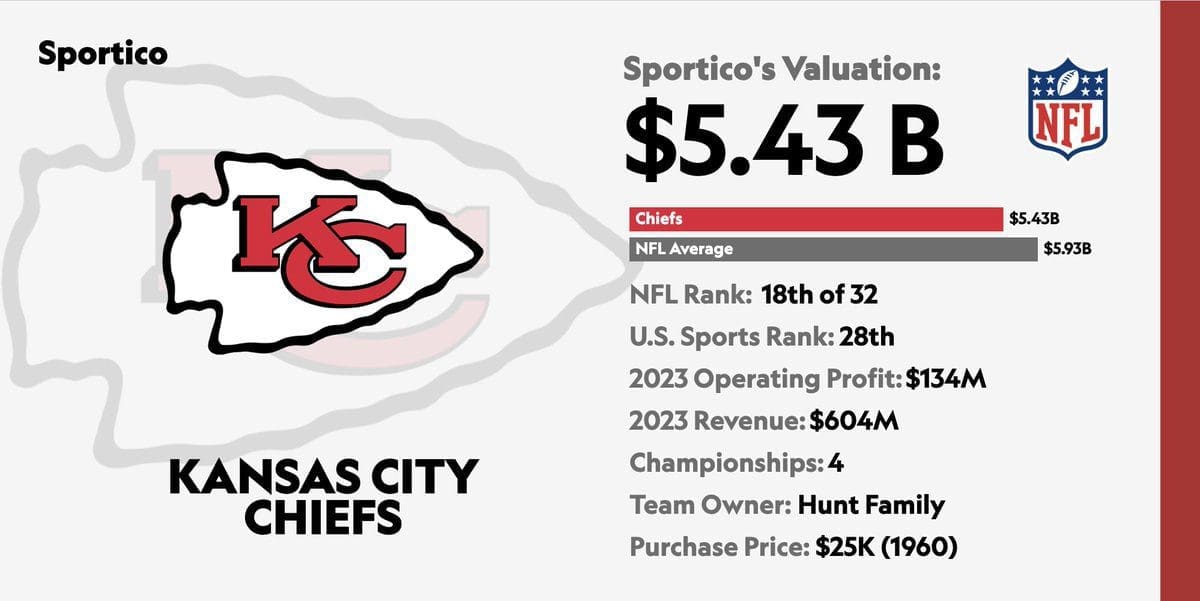

But all of this is done intentionally by sports teams and their owners. The state of Kansas is allowing for this deal to be kept secret until public officials finalize it. But this hasn’t stopped supporters of the deal from continuing to praise it. While a number of the smartest sports business minds consider this deal to be the “most lopsided” in sports history, the Kansas Department of Commerce (KDC) seem confused by anyone who believes that the Chiefs’ $6B+ relocation deal is bad for taxpayers. Officials at the KDC have expressed “confidence” that this deal will be a “windfall for Kansas.” As the Kansas City Star wrote in a recent article, the KDC seems confident yet still can’t actually answer how the state of Kansas can finance 60% of a $4B project with Sales Tax & Revenue (STAR) “bonds backed by as-yet-unrealized sales tax revenue growth across a vast new incentive district.”

But the Chiefs move will create 20,000 new jobs and create $1B+ in economic benefits! Let’s talk about these talking points. These numbers come from a study done by a company called Canyon Research Southwest. Before we get into those estimates, let’s look at the company. Oh boy, does Canyon have quite the history.

- In 2021, the Wichita Eagle wrote an article that described how the city of Wichita gave a company, Topgolf, a $10M tax break based on a report by Canyon Research Southwest. The problem is that the report by Canyon had a “glaring error” in it. The study did not factor in the loss of tourism due to another Top Golf in the area. This is quite the error that seemed to anger some and confuse everyone else. When asked for a response, a Canyon executive, Eric Lander, said that he “probably omitted the Oklahoma City facility by mistake.” He would go on to claim that it had been five years since he did the study, so how could anyone remember it?

- In 2021, a professor at the University of Oklahoma’s Department of Economics wrote a paper titled “When Rent Seeking Smacks You in the Face: TIF and Motivated Reasoning.” In it, the professor wrote how city leaders in Norman were trying to find a way to convince the public that “cannibalization was not a concern” with projects involving tax increment financing. The city of Norman paid Canyon Research Southwest to write a report on a local TIF district. After Canyon issued their report, the professor details how the Canyon report “failed to account for counterfactual growth” and forgot to factor in the “growth in the regional economy as a whole.”

- In 2014, a man named Chris Curtin wanted billions in taxpayer money to create a new shopping district in Overland Park, Kansas. He had no experience with projects like this, but he wanted to move forward with it. Cutris was making crazy assertions of how much this project would benefit taxpayers and how his project would create 20,000 jobs. Eventually, it was found out that he got his numbers from…you guessed it…Canyon Research Southwest. But let’s see how one news site describes Canyon: “(Curtis) hired a man named Eric Lander to create a feasibility study of his project. Lander is a consultant for Canyon Research Southwest who, as many local developers and their attorneys can attest, is good at shaping numbers to make a development proposal look like a slam dunk.”

- Has anyone seen their website? It is directly from 1998.

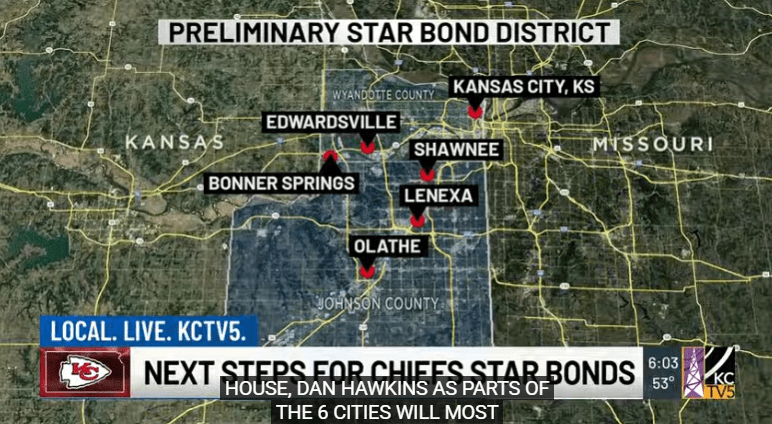

The fact that Canyon is wrong on many occasions and yet continues to get work makes complete sense. Whether they are correct is irrelevant. Canyon is used to sell a project, and that is it. If we look at the estimates by Canyon for the Chiefs project, almost every independent economist has stated that the move makes no financial sense for anyone but the Chiefs. Normally, STAR Bonds capture sales tax revenue generated by new developments and other places around the new project. But in the Chiefs’ case, the boundaries for their district “have not been finalized.” The Chiefs will now be receiving all sales tax revenue from an unknown but large district of people and businesses. Who really cares if these same tax revenues previously have gone to fund pointless projects like “K-12 education, health care services, public safety, and the state highway fund”? And does it really matter that if there is any growth in the project area, any new revenues by the state will be “monopolized for debt service payments?”

When the Star wrote an article on the finances of the Chiefs’ relocation, Justin Marlowe, a professor from the University of Chicago, spoke about the absurdity of thinking that the Chiefs’ move could somehow be a financial boon to taxpayers considering the “massive increase in sales tax collections that you need to be able to have to make a project like that pencil out.” Officials also continue to claim that Kansas taxpayers will be “held harmless” if the project doesn’t financially pan out.

Except the professor, Marlowe notes how this is not accurate:

“Do we default on the bonds and hope that the bondholders are willing to take a haircut, which they won’t be. Which they never are…If it goes to court and there needs to be some sort of negotiated settlement, it’s fair to say that at some point, everyone will look to the state to provide some kind of relief to prevent the Chiefs from leaving, to prevent this otherwise potentially successful development from failing before it has a chance to succeed” – Justin Marlowe, 01/08/2026, Kansas City Star

I thought Matthew Kelly wrote a great article asking why taxpayers couldn’t vote on whether billions of taxpayer dollars could go to this project. Essentially, the state of Kansas allows for lawmakers to use a “special incentive program” that was started just two years ago to fund a project like the Chiefs. The lawmaker who wrote this law (and did not include language allowing for the public to vote on these types of projects) claims that the public doesn’t need to vote since the sales tax is not increasing. I really do hope that this politician understands that while the sales tax will not increase, the money that it brought in to MANY state functions (like public education, facilities, etc…) will now be diverted to the Chiefs project. And as one local leader admitted to a local newspaper, it is likely that taxes will need to be raised in the future if the project does not create this massive revenue from the new stadium.

Keep in mind that this deal is far from finished. When the Chiefs first announced the broad parts of their relocation deal, I assumed that they had spoken to the two counties involved, Johnson County and Wyandotte County. They did not. Therefore, the Chiefs need both counties to agree to “contribute their local sales tax revenue to the stadium debt.” But both counties have stated publicly that they “will allow for a public vote to decide if their city will hand over a large part of their sales taxes.” That is not good news for the Chiefs.